你好。我有些困扰。

我今年57岁,公司前景不好,随时面对失业,目前我没负债。

退休后基本开销大约3800令吉,公积金76万1000令吉,定存55万令吉,一间市价18万令吉公寓自住,租赁地契,还有大约50年。基本退休应该是没问题。

如果我用现金价值购买租金回酬利高的新山关卡房产行得通吗?

只是想到房产价值会提升,现金价值会贬值,现在购买以后留给孩子至少还是升值的。

但想到退休金少了一半,会太冒险了吗?因为退休后没想过要孩子负担我的费用,想要做个有自尊的退休老人。

希望能得到你的宝贵建议。谢谢。

蔡女士

答:

蔡女士你好,关于你的询问。

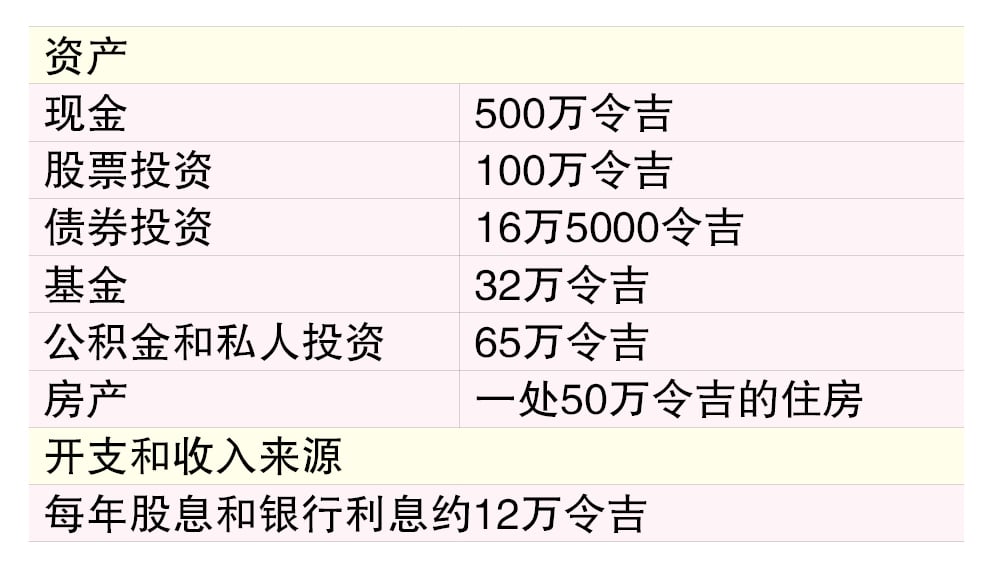

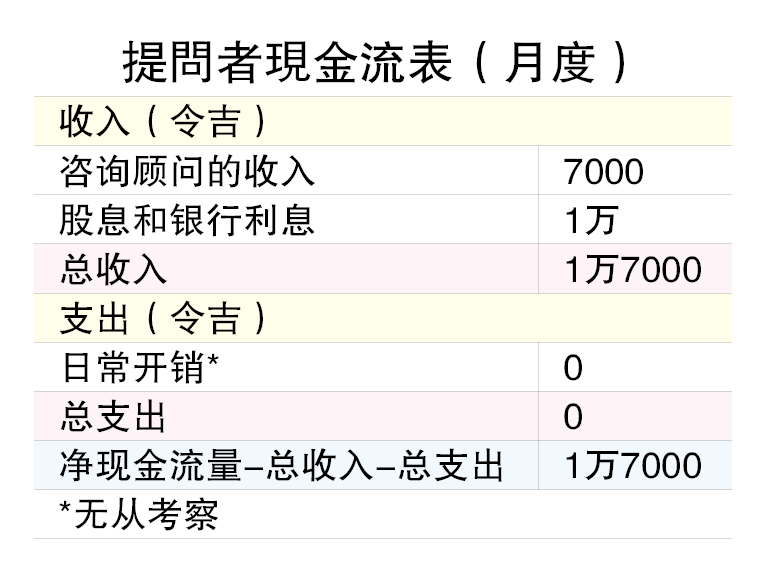

如果计算你现在57岁退休,退休后每月开销为3800令吉,计算每年通货膨胀的5%和活到80岁,你大约需要130万6452令吉作为你23年的退休生活,以你目前的资产131万1000令吉是足够的(还没有包含自住和尚有50年的公寓)。恭喜你可以财务上无忧无虑的退休生活。这里也同时假设你已经做好的财务保障的设立,尤其是医疗、严重疾病、意外和老人残疾的保险保障,最少至80岁或以上,同时避免掉入任何投资圈套,否则一样可以拖垮你充足的财务状况,最后需要继续工作和仰赖孩子的支持。

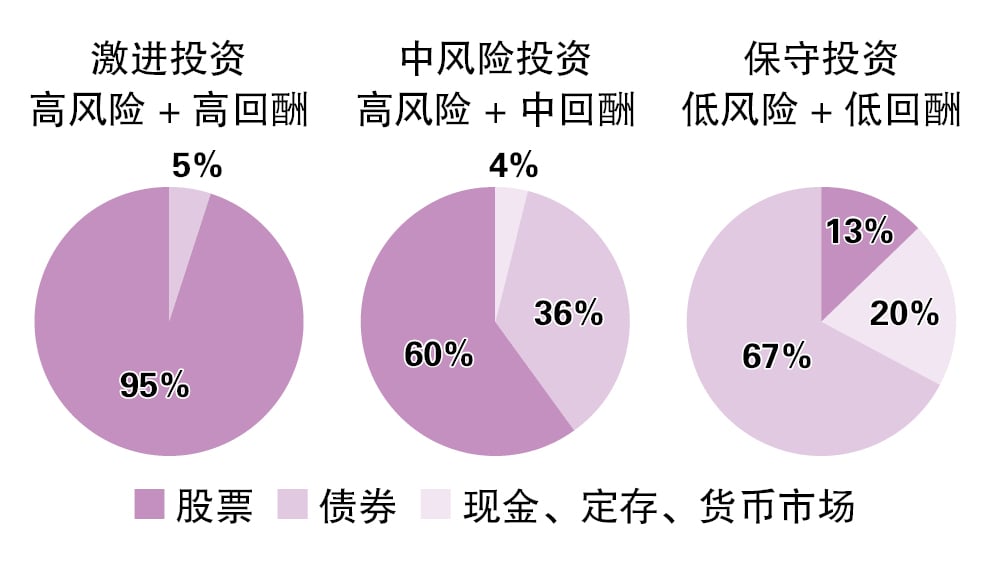

投资新山关卡房产2考量

关于是否应该考虑投资于新山关卡房产,这里需要考量有两项:一、你是否熟悉新山市场,做足了研究功课,同时还听了不少当地人和专业的意见,附近的租金是否客观。之前,柔佛房屋市场确实供过于求,需要去了解现在和未来需求可以消化之前的过度供应;二、房产是属于非流动资产,也就是不容易转换成现金的投资工具,买卖不容易。进入退休的人士,基本上需要80%或以上的流动性和保守的资金/投资。房产确实可以跑赢通货膨胀,但是最关键还是地点,没有比地点更重要了。

可申请灵活贷款 须购买MRTA

如果有投资房产的经验,做足了功课,又坚持要拥有一间实物投资收租金,那么可以考量向银行申请灵活贷款(Flexi Loan),因为你有很多流动现金,可以非常容易得到贷款,不需要动用你的现金和公积金(心安),同时你可以非常自由调动你的现金来还贷款,比如你把现金放入低于你借贷的数额(如果放入现金等于贷款数额,贷款户头就会结束),你的利息基本可以忽略,需要钱时再把钱从Flexi Loan户头提出,这时贷款利息又开始启动,这就是灵活贷款的好处,但是每间银行的贷款条款稍微有不一样,一直跟进时代变动而变更,可以去比较,拿最适合你的,同时别忘了购买递减式房屋贷款保险(MRTA),避免把债务留给子孙。当你的房产有租金,就用租金去支付贷款数额。当你的这一间房产有稳定租金收入,基本可以应付超过75%或以上的每个月贷款数额时,就可以考量复制同样的手法购买第二间房产。

如果要走比较保守路线的话,可以考量购买产托(REITS),流动性高,好像随时可以买卖多或少,同时有非常稳定的租金,还有专业公司/人士管理。这是一种懒人房产投资方式。

亚洲产托回酬诱人

亚洲的产托回酬是非常吸引人的,前景也非常光明,尤其是超级大城市比如吉隆玻、新加玻、香港、上海、悉尼等等。产托种类也是有讲究的,比如目前非常火热的是零售(Retail)和工业(Industrial),而医疗(Health Care)和工业比较不受市场好坏影响,同时租客合约都是长期的。暂时避开办公室产托,因为现在疫情后,大家办公(和生活)方式有变,可以无需办公室,就可以随时随地办公,同时居家办公也变成新工作方式,多以对办公室需求少了很多,除了少数黄金商业地段之外。

至于选择哪一种,或同时拥有两种,都应该是根据你的投资喜好,接受度和经验来决定。

关于说目前工作不稳地,其实,最坏没有工作,可以考量找自己兴趣,善用之前累计的经验和人脉,而又轻松的工作来做。现在无所事事的退休人士风险最高,太得空反而无聊,胡思乱想,闲出病来,但是不管如何,做你喜好的和让自己有寄托就对了,这一点你最清楚。

最后,祝福你,退休快乐,同时投资大赚。